-

Find Out About Insurance Provider As Well As Their Functions In Financial Activities

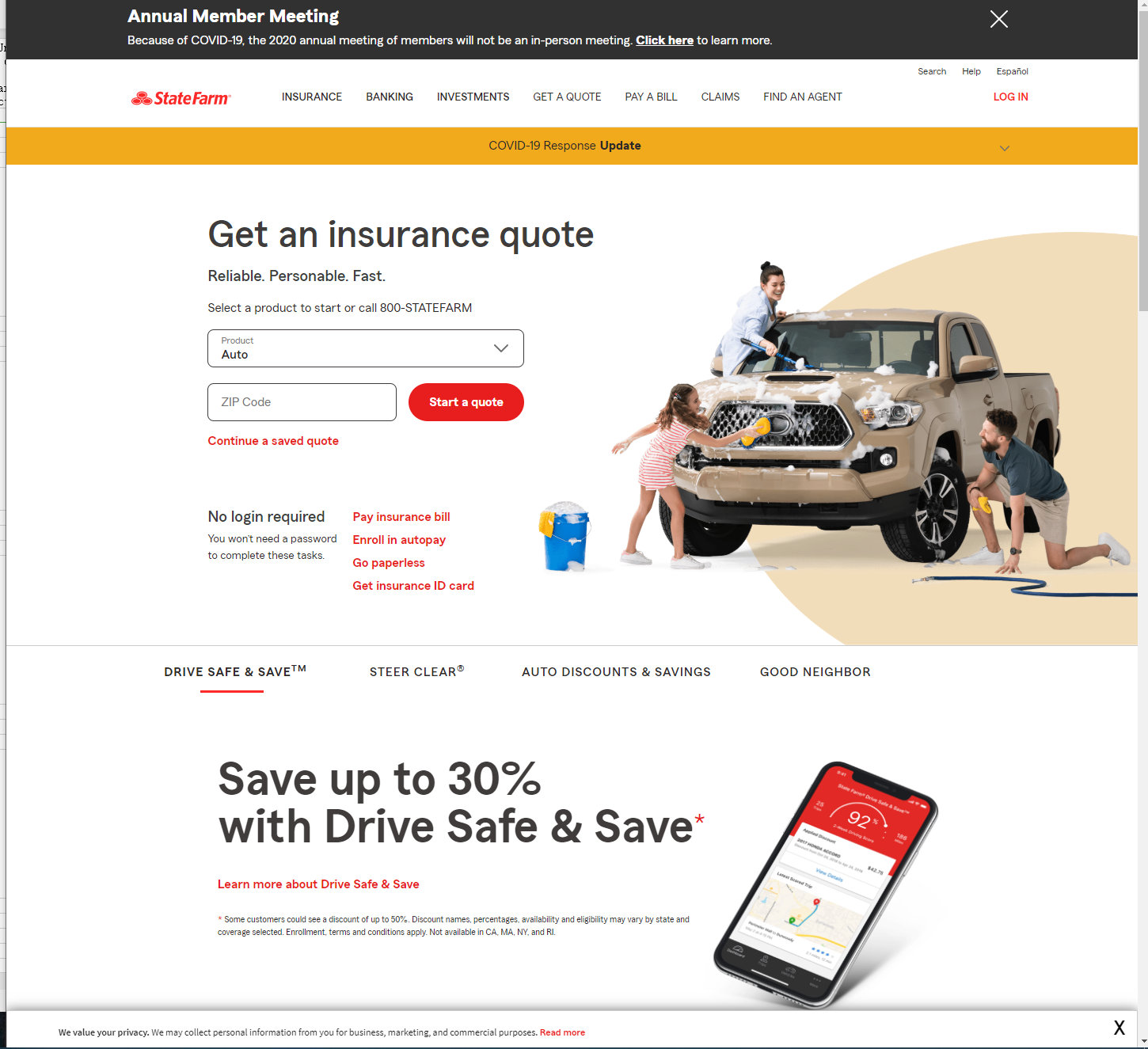

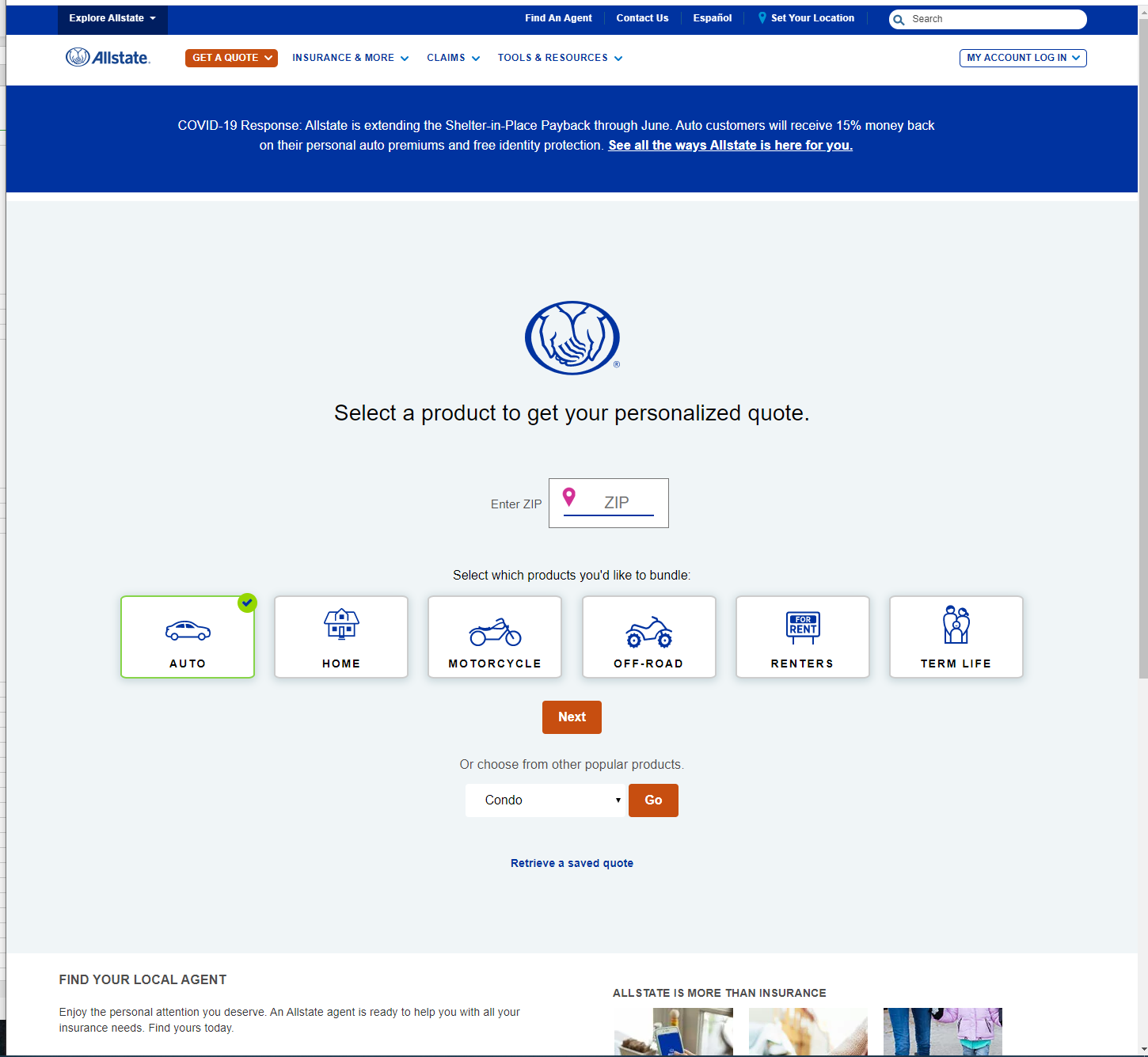

Insurance provider satisfy the feature of safeguarding the physical stability of the item or individual they protect. Its purpose is straightforward; it assists protect all the economic risks that your insurance contract covers. This choice is available to every person no matter their country of origin; each insurance firm functions in a similar way.

The benefit of insurance companies is that it shields all those damaged properties that were previously guaranteed. Cars, homes, or even individuals can acquire insurance against threats of any kind. Insurance protects nearly whatever that happens to your product or physical stability; it views to pay all those costs.

To take pleasure in the insurance company, you need to first make a contract that specifies what type of insurance you want to acquire. The damages insurance coverage can be full or for some particular dangers or crashes. The kind of payment in the insurance provider is periodical, as well as its value varies by each insurer.

Many people pay full-risk insurance and never benefit from it while others do not have and also require it. It is better to have risk insurance and also not require it than to need it at some time and also not have it.

Being secured is a good idea since at some point, your physical stability can be influenced at the least predicted moment.

With life insurance policy, you will certainly take pleasure in top quality treatment when you may not have financial stability. Insurance will certainly cover your expenses also after you die; lots of people choose this solution instead of real estate or vehicle. Real estate insurance is a terrific choice to secure your house versus fires, floodings, as well as natural representatives that put it in danger.

What Is As well as How Does The Insurance Agreement Job?

The insurance contract is the contract reached between the insurance company and also the policyholder where threat settlements are established. This arrangement establishes certain fire insurance coverage laws at a particular degree, reduced seriousness mishaps. The insurance holder or specialist need to concur prior to releasing that insurance plan that will certainly cover the concurred data.

You need to define the following factors in the insurance plan:

- Name as well as surname of the specialist, current address.

- Dangers specifically covered and also the guarantees in the contract.

- List of items insured by property or car agreements.

- Extent of insurance protection.

- Tax obligations.

- Costs due date as well as methods you pay.

- Duration of the contract dated and also defined.

- If you have a mediator, you need to provide your name and reasons for the intervention.

With all these information, you have assurances in your contract, as well as the insurer can give it to you without troubles. Each point must be extremely details to ensure that both celebrations agree with the insurance coverage of the object or life insurance. The range of protection will establish if the damage drops within the agreement or how much it can protect it.

The insurance policy can be managed by you or by 3rd parties, such as a lawyer or relative specifying the cause. All life insurance records should be with your authorization to obtain the solution when you pass away. The insurance amounts differ relying on what type of contract was submitted, including this:

- Life insurance or defense of physical integrity.

- Passion insurance: things, thefts, fires.

- Compulsory insurance: sports, vehicular.

- Other insurance in the contract.

Learn more about The Types Of Insurance

Among the kinds of insurances are: for a particular property as well as life insurance, observe them as well as know all the policies:

Product particularly:

- Fire insurance: the insurance firm will certainly honor you settlement if your home catches fire or a particular property suffers these product damages.

- Goods insurance: If a product is damaged in an activity or shipment of product, your insurance will certainly offset it.

- Burglary insurance: the insurance firm takes on to secure your specific residential or commercial property versus theft.

Life insurances

- Physical honesty insurance: you will certainly be made up if you experience a blow or contusion that the insurance company covers on an item. For example, if your physical integrity is affected secretive transport, the insurer will guarantee your protection.

- Death insurance: all those affected within the insurance agreement are made up at the owner's desiccation. Generally, numerous member of the family or recipients of the insurance usage it to cover funeral costs or do not gather compensation.

Various other insurance contracts:

- Sickness insurance: the agreement will undergo indemnification by the guaranteed if he struggles with a details illness.

- Total danger insurance: the contract states all life, realty, and vehicle assurances, to name a few, that go through a threat that should be compensated.

- Travel insurance: you will be compensated for experiencing a certain crash during your trip.

- Orphan's insurance: it is given to all those children under the age of 18 for the drying up of 1 or both parents.

- Accident insurance: you will have settlement for experiencing a crash within the business or factor suggested in the contract.

All insurance holders must specify the reason for acquiring the insurance agreement. The indemnity will certainly cover the entire price or a part as defined in the arrangement with the insurance firm.

Problems Stated By Insurance Provider

Insurers maintain an order in each agreement that they assign for their insurance companies or safeguarded to offer assurances from both sides. It is an extremely profitable organisation that will safeguard your life or things as long as you comply with the policies supplied in the contract. If you break the regulations, your insurance will not be approved, and also defense will not be offered to you.

Among the conditions of the contract are:

- Requirements of the agreement to demand, from the settlement of fees to the amount of compensation.

- To demand payment, you have to ensure that the policy covers these dangers or problems to your object.

- The cash will be sent out to the insurance protégé or third party that you formerly consisted of in the policy.

Other conditions within the agreement take worth, but these three are one of the most vital and also should be born in mind. Insurance provider advertise your safety by advising that you do not attract your life to gather the money. Take the insurance policy as a vibrant device to safeguard on your own or your items at less anticipated times.

To ask for payment, you have to talk to the insurance agent or boss of being the insurance company's voice. The agent will certainly establish if its problems apply to the paid policy as well as indicate the actions to follow. In case of complaints, your insurance broker will certainly provide you with the essential info to report the insurance company.

Worldwide, one of the most requested insurance coverage are life insurance policy policies, as they provide fantastic performance after death. Another typically utilized is overall danger insurance, where different real estate as well as car elements are covered. Go with a dependable insurer that guarantees your policy, as well as your payments are attractive.